New Japan Consumption Tax System

Summary of the New Japan Consumption Tax System

Japan will introduce from October 1st, 2023, a new Japan Consumption Tax (JCT) system. Under the new system, issuers of invoices will have to register with tax office to get a consumption tax ID that will need to be printed on invoices compliant with the new system called “qualified invoices”. Japan System will become similar to VAT systems in Europe.

Consumption tax claim on purchases (input consumption tax) will not be possible anymore if invoices are not qualified with means that they do not match requested format and do not bear the consumption tax ID number of the JCT registered supplier.

Deadline for companies to register and get a Japan Consumption Tax system ID is September 30th, 2023.

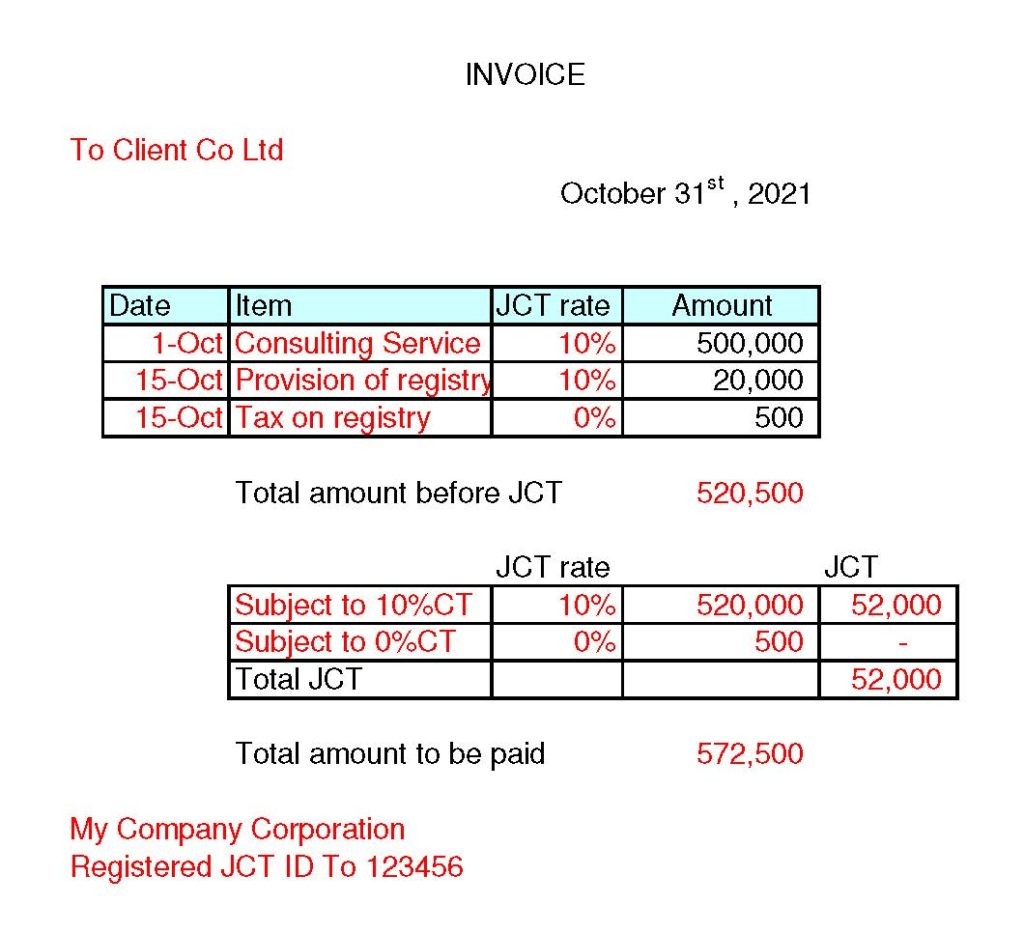

Information necessary on new qualified invoices are:

- Name and the tax ID number of JCT Invoice issuer

- Date of invoice

- Details of invoice items (especially for reduced tax rate),

- Invoiced amount with the applicable tax rate,

- Consumption tax amount with applicable tax rate

- Customer’s name

JMC recommendation for new Japan Consumption Tax System

JMC recommends its clients to register with tax office from October 2022 to avoid the last-minute rush from March 2023 on submission of tax return.

The time between October 2022 till September 2023 can be used to upgrade the current accounting system to satisfy requirement for new Japan Consumption tax system.

The main points to prepare for the New Japan Consumption Tax System are:

- Prepare your invoicing system to the new requirement (see above Information necessary on new qualified invoices)

- Communicate with suppliers to confirm that they will meet registration deadline after September 30th, 2023

- Adapt accounting system to both register invoices from registered supplier and non-registered suppliers

Disclaimer: This information is provided for illustrative purposes only. JMC cannot be held liable for any decisions made based on this information. For any advice regarding taxes in Japan, a licensed tax accountant should be consulted.